Author:

Fullerton Fund Management

10 April 2024

In recent years, global structural shifts, persistent economic turbulence, a series of international shocks and crises, and the continued impact of digitalisation have accelerated the pace of change. We wanted to find out if, and how, the changing investment landscape has affected the attitudes, behaviours and expectations of investors like you, and if you have found the investment path to be challenging.

Some of the insights from the ‘Rethinking Investing’ report highlights some anticipated findings: the need for careful planning for a comfortable retirement given that relying solely on CPF is inadequate (a topic we covered in our previous special report), concern of inflation, and the growing role of technology in managing finances.

The report also brings to light several encouraging revelations. The investors we surveyed have largely stood firm in the face of market uncertainties, maintaining their focus on their financial goals. If anything, the bite of inflation has nudged many to embrace risks with a broader, long-term view, accepting the possibility of some short-term setbacks. Balancing a wariness of loss and the need take risks, they’ve also acknowledged the need to gain financial literacy, stay nimble and assume responsibility of their investment journeys.

Overall, our findings do not just reflect an evolving investment landscape; it reveals a positive shift in the investor mindset as well to navigate the new financial realities.

Survey methodology

Working closely with Blackbox Research, we surveyed 500 active investors in Singapore with at least 3 years of investing experience and investable assets of at least SGD 40,000. Respondents were carefully selected to ensure a balanced and representative cross-section of investors across age, gender, marital status, ethnicity, income and employment status.

Key findings

Persona for the modern Singapore investor

Snapshot of Singaporeans’ investment blueprint

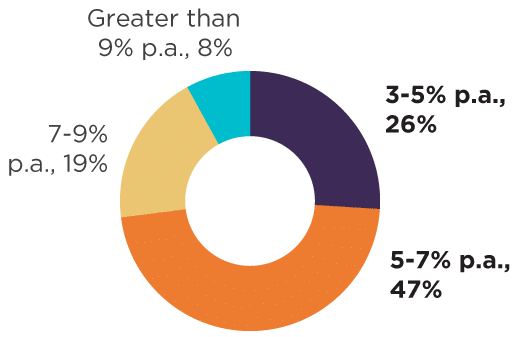

Target investment returns

Close to three-quarters of investors are targeting a return of 7% p.a. or less

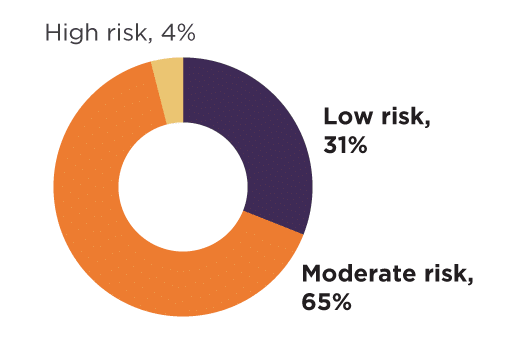

Investment risk appetite

Investors consider themselves low-to-medium risk takers

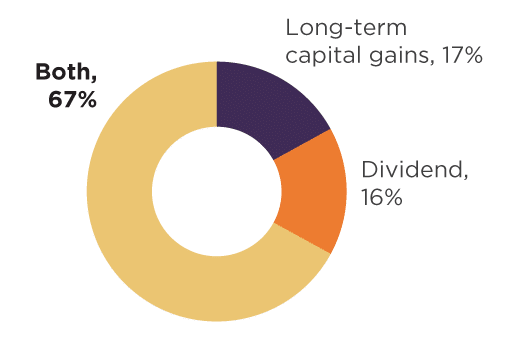

Returns preference

Investors adopt a mix of both capital gains and dividends in their investment approach

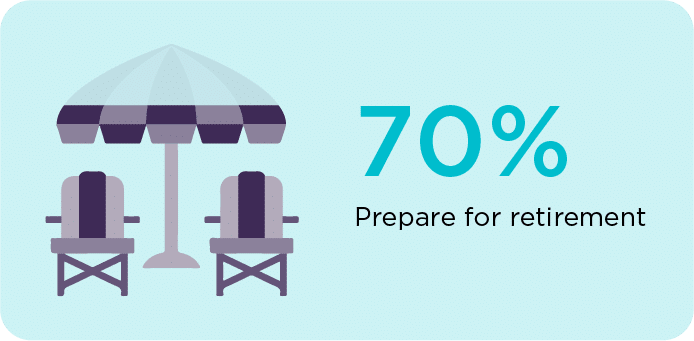

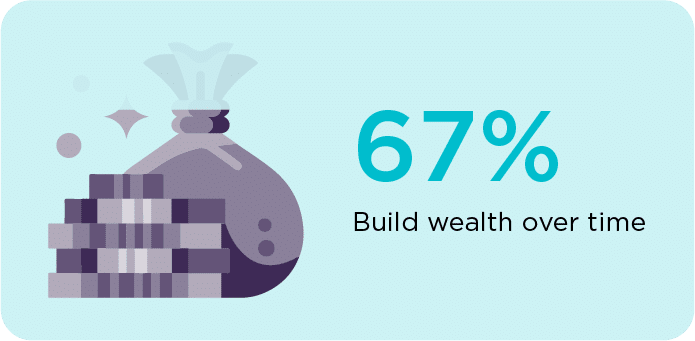

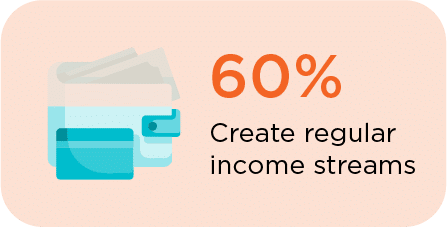

What are their top investment goals?1

1. Respondents may select more than one investment goal.

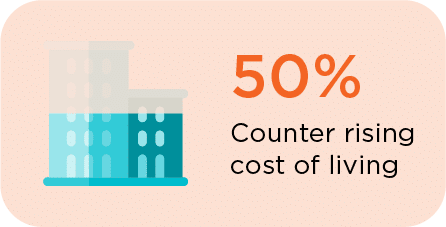

Majority of investors have maintained or increased their risk appetites over the past 12 months

The desire to achieve financial resilience has supported investor risk appetite in recent times.

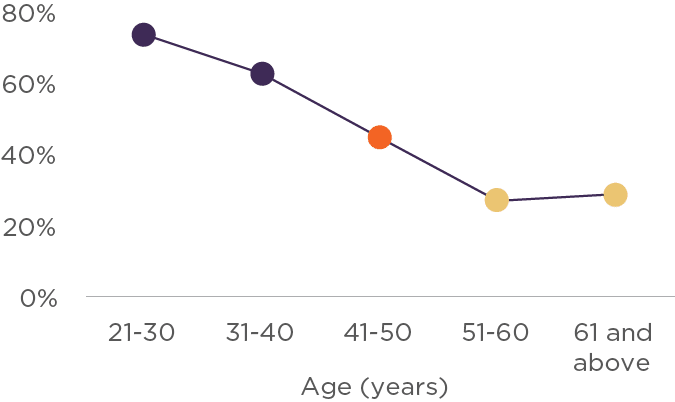

21–30-year-olds have shown the greatest propensity to embrace risk, as compared to those in the 51-60 cohort who are relatively more circumspect

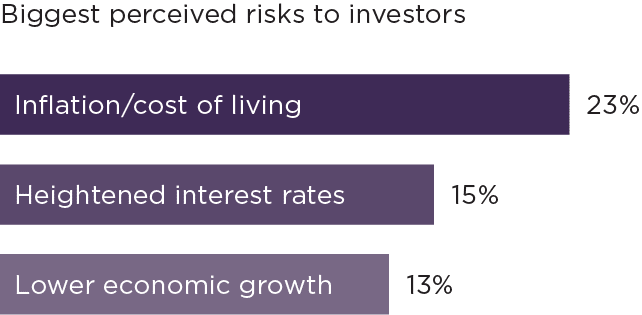

What are their biggest investment concerns?

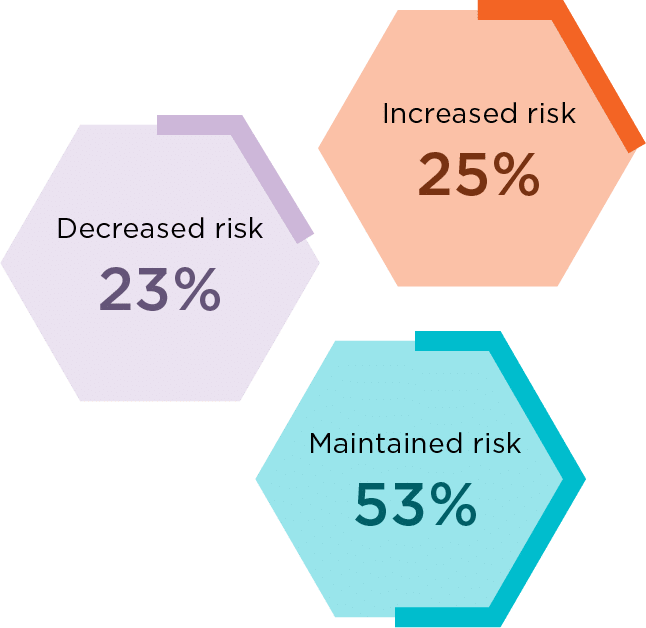

Optimism chiefly spurred by encouraging economic forecasts, moderating rate hike expectations and confidence in government measures to support Singaporeans

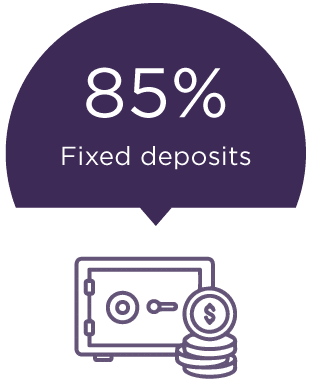

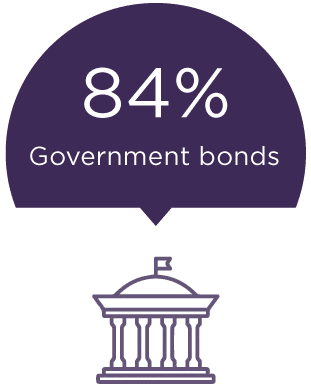

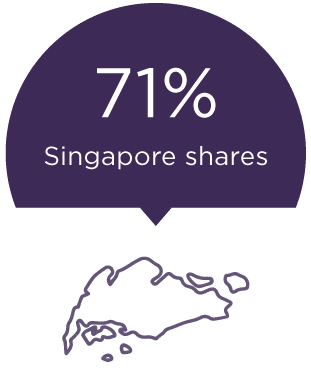

Investments most favoured now2

2. Respondents may select more than one favoured asset.

What are their biggest investment concerns?

Inflation fears continue to haunt investors

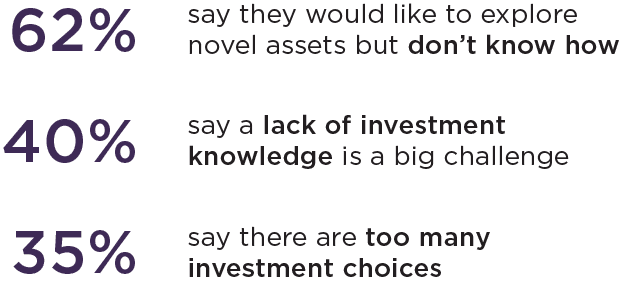

Investment challenges encountered3

3. Respondents may select more than one challenge encountered

Investors seek opportunities in structural themes and alternative assets to make their portfolios more resilient

4 in 5 agree that a resilient portfolio requires investments into sectors poised to drive the future economy

Almost 1 in 2 (48%) - and three-quarters (74%) of those aged 21-30 – expressed interest in alternative assets

3. Respondents may select more than one challenge encountered