Sustainability is a commitment that permeates how we invest and operate as a business.

As an active asset manager and responsible investor, Fullerton integrates Environmental, Social, Governance (ESG) factors in our investment process. We view active ownership as one of the most effective mechanisms to minimise risks, maximise returns and create positive impact on society and the environment. Therefore, we actively engage with our portfolio companies as stewards and votes shares in the best interest of clients.

Beyond that, Fullerton seeks to contribute positively to the community and the environment, as a socially responsible organisation.

Inaugural Sustainability Report

The inaugural sustainability report of Fullerton Fund Management (“Fullerton”) sets out Fullerton’s strategy, approach and progress to sustainability and climate resilience as an asset manager.

This report builds on our Task Force on Climate-related Financial Disclosures (“TCFD”) and is guided by SASB Sustainability Accounting Standard (“SASB Standard”) for Asset Management & Custody Activities.

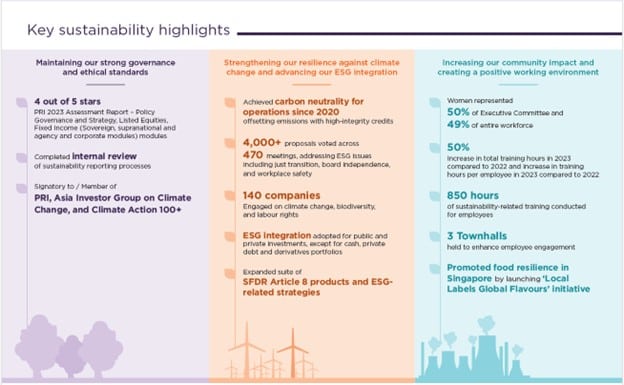

With sustainability being as much a commitment as a journey, we have advancements in several areas, as shown in the key sustainability highlights below.

Download the Sustainability Report here.

The video below provides an overview of Fullerton’s sustainability journey and the key highlights of the Sustainability Report.